Crypto collapse leaves Nigerian student ambassadors in lurch

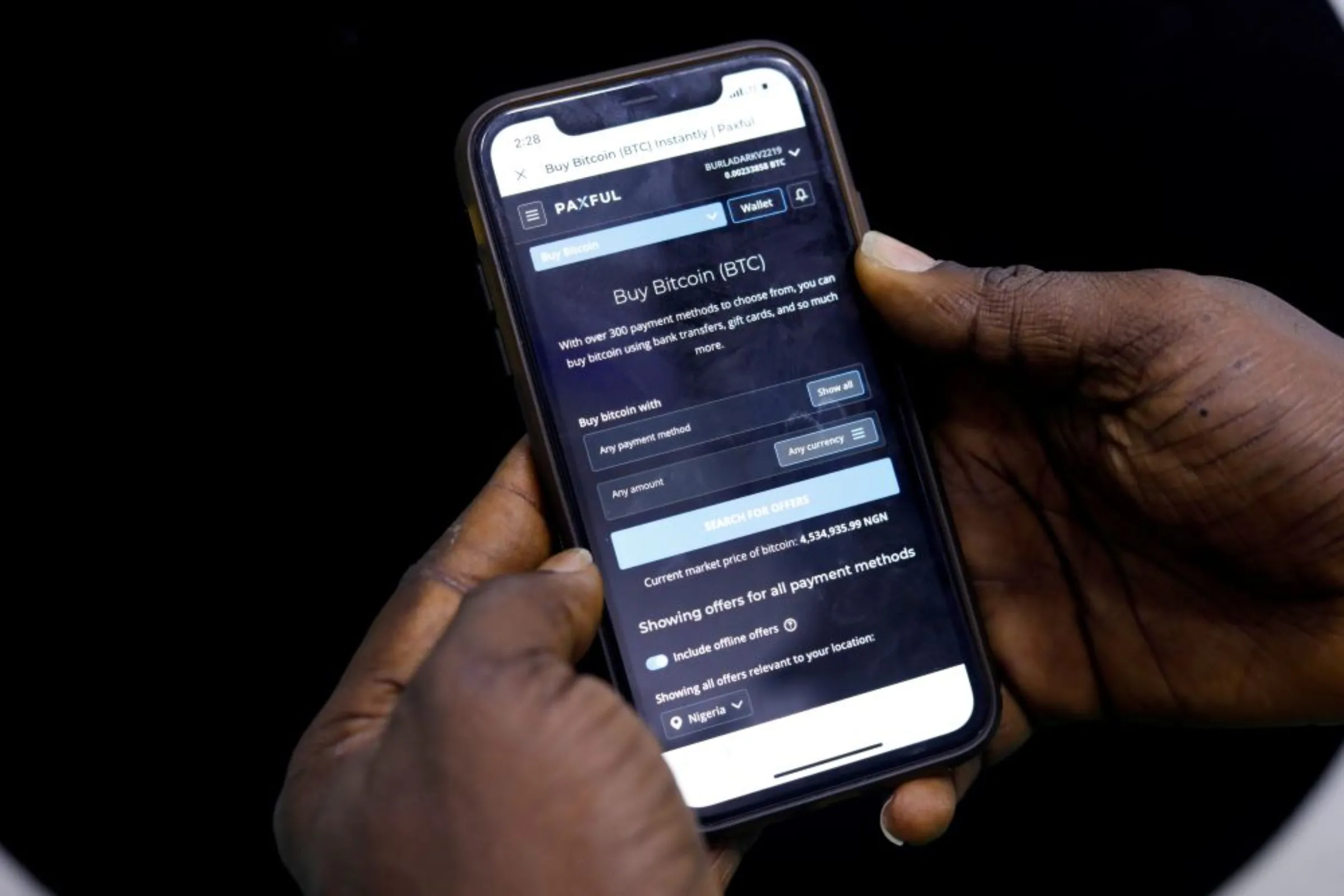

A bitcoin user buys bitcoins with naira on Bitcoin Teller Machine in Lagos, Nigeria September 1, 2020. REUTERS/Seun Sanni

What’s the context?

Failed crypto exchanges like FTX and AAX used Nigerian students to recruit investors - now the ambassadors are on the hook

- Crypto exchanges relied on Nigerian youth to boost trading

- Young drawn to crypto amid uncertain economic climate

- West Africa was a key focus for FTX and AAX

LAGOS/NEW YORK - Nigerian student Cosmas Elijah's phone has been ringing off the hook since crypto exchange AAX announced a freeze in withdrawals for millions of customers in November.

The collapse of the Hong Kong exchange came on the heels of the implosion of FTX crypto exchange, leaving students who had been tapped to recruit fresh investors in West Africa in a precarious - and even dangerous - predicament.

"When I look at my phone, there is someone threatening to harm me if I don't refund their money," said Elijah, 22, a student at Ignatius Ajuru University in southern Nigeria.

"I sold a piece of land, even my bed ... all I bought with the money I made from crypto, to pay people. It is still not enough," he told Context by phone.

Elijah is one of dozens of students in Nigeria recruited by investor-hungry firms to market cryptocurrencies to their peers, part of an industry push to expand their reach in West Africa, where economic instability has drawn in desperate users.

Enlisted students had to meet monthly targets mandating both the number of new investors won and total funds deposited. Some were paid a monthly stipend for their recruitment work; others worked for free in the hope of earning referral commissions.

AAX student ambassadors were asked to recruit 50 users to trade $250 weekly on the platform, and given a monthly target of $50,000 in trading volume, two ambassadors said.

The exchange recruited nearly 50 ambassadors in Nigeria as of late-2022, according to documents seen by the Thomson Reuters Foundation.

Those who met the targets were rewarded.

Abolaji Odunjo, a gadget vendor who trades with bitcoin, demonstrates a bitcoin application on his mobile phone in Lagos, Nigeria August 31, 2020. REUTERS/Temilade Adelaja

Abolaji Odunjo, a gadget vendor who trades with bitcoin, demonstrates a bitcoin application on his mobile phone in Lagos, Nigeria August 31, 2020. REUTERS/Temilade Adelaja

FTX campus ambassadors were tasked with recruiting 20 users a month to invest $50,000-$100,000 in total.

The students earned commissions on every new signon.

They coordinated and shared photos of promotional events and activities with country managers in Telegram groups. Those who met their monthly targets received an additional $800 in cash.

"It was always: 'you must get 100 people, you must bring students, you must refer, you must get them to bring money,'" said Mary, 22, who joined FTX as an ambassador at the University of Nigeria, Enugu.

She asked to be identified only by her first name, for fear of retaliation.

Demonstrators talk to a police officer during a protest over alleged police brutality, in Lagos, Nigeria October 12, 2020. REUTERS/Temilade Adelaja

Demonstrators talk to a police officer during a protest over alleged police brutality, in Lagos, Nigeria October 12, 2020. REUTERS/Temilade Adelaja

Left in lurch

Crypto adoption is growing in Africa, especially in Nigeria, which ranks 11th on a global ownership index compiled by research firm Chainalysis, despite an official crackdown on crypto trading in the country.

It gained wider popularity in 2020 as Nigerians at home and overseas donated thousands of dollars in bitcoin to fund youth-led protests against police brutality, boosting its use among a demography that is increasingly wary of institutional scrutiny.

But inflation, unemployment, and rising poverty have made it a lifeline for young Nigerians - who make up more than 60% of a population topping 220 million people - and who have turned to crypto trading and recruitment as a new way to earn a living.

"It has given students like me financial freedom," said Yemi, 22, a former FTX ambassador at the University of Lagos, who asked to be identified only by his first name.

"We have been able to escape having to look for jobs when we finish, because there are no jobs."

Plus, when striking lecturers left students idle and out of class for months, it presented a perfect opening for crypto companies hunting for a cheap and willing workforce.

Peter Howson, a professor at Northumbria University, said the ambassador programmes were exploitative.

"Exchanges are disingenuously recruiting students to push Ponzi schemes on the world's poorest and vulnerable communities," said the British expert on crypto adoption.

"Ambassadors get recruited, and are left in the lurch."

Well-planned robbery

Elijah was arrested briefly last month after angry investors who had parked $30,000 in AAX on the student's recommendation reported him to authorities in a bid to recover their funds.

Two other AAX ambassadors said they had gone into hiding out of fear they would be harmed by investors they had recruited.

Another AAX ambassador, Abduraoff Aderonmu, was recruited at the University of Ilorin, and encouraged to meet weekly targets of finding 50 new traders.

He hosted events at his school and convinced dozens of fellow students to put thousands of dollars into the exchange.

In November, AAX blocked customer withdrawals from its platform pending a "system upgrade" it said was vital to protect users from "malicious attacks".

"It was a planned scam from the beginning ... a very well-planned robbery," Aderonmu said.

AAX did not respond to a request for comments.

Ben Caselin, a former vice president of marketing at AAX, said West African students were good candidates for crypto as they were often shut out of mainstream banking.

Caselin resigned from AAX in November, after the exchange stopped processing withdrawals.

"It's a very bad situation," he said in an interview, though Caselin still favours pushing crypto takeup in West Africa.

"In emerging markets, especially West African countries, the students are a very important demographic to be part of this growing industry," he said.

Personal piggy banks

The collapse of FTX triggered a knock-on effect that tanked the value of various tokens, and prompted users to withdraw from exchanges, including some in Africa, where users had treated them as banks to keep their money.

FTX also made West Africa a particular focus of its business expansion, with founder Sam Bankman-Fried personally appealing to crypto users in the region to trade on his exchange just days before its collapse.

In Nigeria, FTX had recruited a class of 19-year-old students like Mary, who was asked to onboard 20 students a month and organise FTX "education-focused" events.

She even distributed FTX fliers at her church gatherings.

"I had to get creative. I was thinking of how people will say 'wow' when I post photos of the events on social media," she said. "I was young. It was a big achievement for me."

But now that FTX has gone into bankruptcy, and its founder is under indictment, Mary feels used.

"I started thinking, there are universities, high schools in America - they don't host crypto programmes the way we do in Africa, especially in Nigeria," she said.

"They were using us to sell a product that they can't sell on their own in Africa."

(Reporting by Bukola Adebayo and Avi Asher-Schapiro; Editing by Lyndsay Griffiths.)

Context is powered by the Thomson Reuters Foundation Newsroom.

Our Standards: Thomson Reuters Trust Principles

Tags

- Cryptocurrency

- Financial regulation

- Underground economies

- Tech solutions