Taking investment treaties to the world court over climate

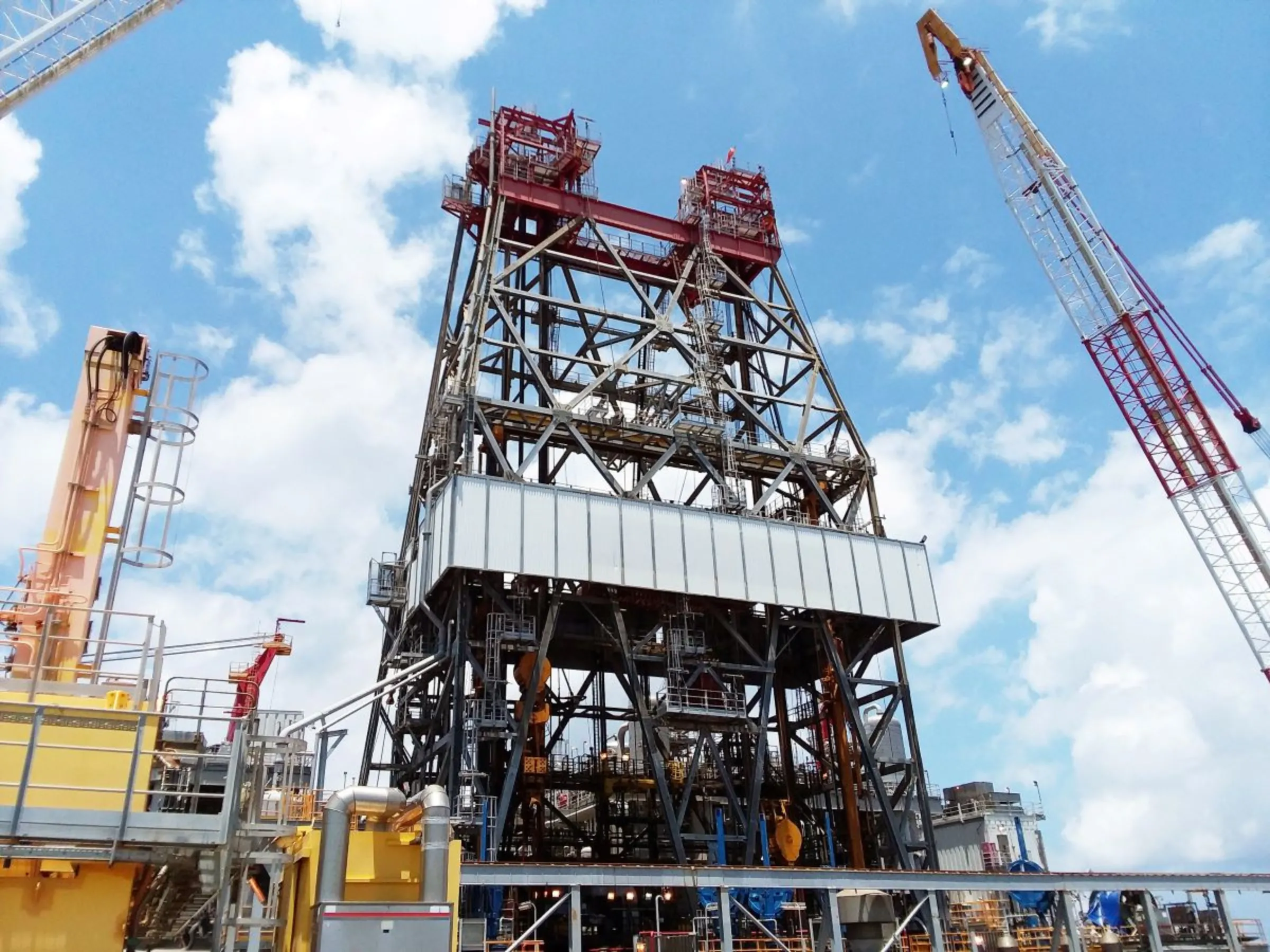

A massive drilling derrick is pictured on BP's Thunder Horse Oil Platform in the Gulf of Mexico, 150 miles from the Louisiana coast, May 11, 2017. REUTERS/Jessica Resnick-Ault

International Court of Justice should address investment protection in its advisory opinion on states’ duty to take climate action

Lorenzo Cotula is a principal researcher and head of the law, economies and justice programme at the the International Institute for Environment and Development (IIED). Camilla More is a researcher in IIED’s Global Climate Law, Policy and Governance team.

The world’s highest court has the opportunity to enable a step-change in the fight against climate change. The International Court of Justice (ICJ) will produce an advisory opinion on whether states have a legal duty to take climate action after Vanuatu led efforts to secure a U.N. resolution starting the proceedings. Momentum is now building as the deadline for submissions to the court, in January, looms closer.

International law provides solid foundations for the court to recognise climate obligations. For example, longstanding rules on preventing environmental harm require states to use all the means at their disposal to ensure activities within their jurisdiction respect the environment of other states and of areas beyond national control.

Meanwhile, U.N. human rights bodies have made it clear that climate change adversely impacts the effective enjoyment of internationally recognised human rights, including the right to life, food, health, housing, self-determination, safe drinking water and sanitation, and development. Similar sentiments have formed part of judicial rulings in Australia, Colombia, the Netherlands and the United States.

In clarifying states’ climate obligations, the ICJ advisory opinion proceeding can also provide an opportunity to address some thorny legal issues, specifically on investment protection treaties and the associated arbitration system known as investor-state dispute settlement (ISDS).

Mitigating climate change requires measures to regulate or phase out carbon-intensive activities. But under the terms of investment treaties, transnational businesses that have invested in fossil fuel production can seek damages from governments for conduct that adversely affects their activities, claiming the measures breach investment protection standards.

The Energy Charter Treaty, a multilateral agreement ratified by some 50 countries in Europe and Asia, protects a particularly large volume of fossil fuel assets. But there are thousands of - mostly bilateral - treaties with comparable clauses, many concluded with developing countries.

Fossil fuel companies are prolific users of this system. To give just one example, a British oil company successfully sued the Italian government for blocking a planned project off Italy’s Adriatic coast after parliament banned oil drilling within 12 nautical miles of the country’s shoreline. A coal phaseout in the Netherlands also triggered legal claims.

The sums involved can be hefty and the problem is systemic. Research by the International Institute for Environment and Development showed that most foreign-owned coal plants around the world are protected by at least one investment treaty. Subsequent studies found that a sizeable share of oil and gas extraction projects are also protected by the treaties, with conservative estimates of potential liabilities running into the hundreds of billions of dollars.

Deep reforms needed

The Intergovernmental Panel on Climate Change (IPCC) noted that this system can make it more costly, and therefore difficult, for states to take climate action. The payments can also divert public funding from investments in the energy transition and climate adaptation.

Aligning investment treaties with the Paris Agreement goals requires deep reform. The treaties are mainly bilateral and regional but effective responses need collective thinking and coordinated action. This calls for nurturing multilateral spaces where states can develop concerted reforms beyond the confines of existing policy processes.

But reforms take time and depend on power relations among states. The ICJ’s advisory opinion proceeding offers an opportunity to set some parameters based on law rather than politics. For example, the court could clarify how climate obligations should affect the interpretation of other rules of international law, including investment protection treaties, to ensure their application does not undermine the ability of states to honour their climate obligations.

For the court to consider this issue, states would need to highlight it in their submissions, articulating not only the legal basis for climate obligations but also the implications for wider international law. As the window to prevent climate disaster narrows, there is a compelling case for doing so.

Any views expressed in this opinion piece are those of the author and not of Context or the Thomson Reuters Foundation.

Tags

- Clean power

- Adaptation

- Climate finance

- Fossil fuels

- Net-zero

- Climate policy

Go Deeper

Related

Latest on Context

- 1

- 2

- 3

- 4

- 5

- 6