In crisis-hit Pakistan, rogue loan apps add to financial pain

A shopkeeper uses mobile phone as he sits outside closed shops during a shutter down strike called by the Tehreek-e-Labbaik Pakistan (TLP), a religious and political party, against inflation and recent increase in prices of petroleum products in Karachi, Pakistan February 27, 2023. REUTERS/Akhtar Soomro

What’s the context?

As low-income Pakistanis fall foul of unscrupulous lending apps, complaints of fraud, data abuse and blackmail alarm authorities

- Unscrupulous loan apps meet demand for instant credit

- Borrowers hit by sky-high rates, threats and data abuses

- Tougher regulations needed, say digital rights groups

LAHORE - Unemployed Pakistani software engineer Ali thought he had found a way to pay his overdue electricity bill when he took a small, 30-day loan from a digital lending app late last year.

The money landed in his account minutes after completing the application - a big draw of the lending apps that are spreading fast among lower-income Pakistanis grappling with an economic crisis and a dearth of accessible bank loans.

"In only 10 minutes, the 15,000 Pakistani rupees ($53) that I had applied for was in my account minus the processing fee," the 30-year-old, asking not to use his real name, told Context as he sat in the office of his brother's garment factory in Lahore, Pakistan's second-biggest city.

But just seven days later, his relief turned to fear as he received calls demanding the money back immediately or ordering him to pay a penalty for a one-week extension.

"They phoned me and my contacts even on Sundays, hurling threats and abuse. It got so stressful I took the offer of another lending app to pay off the loan," he said.

The new lender also turned out to be unscrupulous and charged a sky-high interest rate, meaning his initial 15,000-rupee loan ending up costing him 230,000 rupees.

Experiences like his are increasingly common as more people in the country of 220 million turn to dozens of mobile-based lenders, creating fertile ground for scams and fraudsters, digital rights and consumer defence groups say.

Many of the apps are regulated, but they too are the source of hundreds of complaints filed so far this year with the country's capital market regulator, the Securities and Exchange Commission of Pakistan.

Men reach out to buy subsidised flour sacks from a truck in Karachi, Pakistan January 10, 2023. REUTERS/Akhtar Soomro

Men reach out to buy subsidised flour sacks from a truck in Karachi, Pakistan January 10, 2023. REUTERS/Akhtar Soomro

Data abuse, blackmail

Reflecting a jump in smartphone use, the number of Pakistanis using personal finance apps more than doubled to 19% in 2022 from two years earlier, boosting low rates of financial inclusion, found a survey earlier this year by Karandaaz Pakistan, a nonprofit.

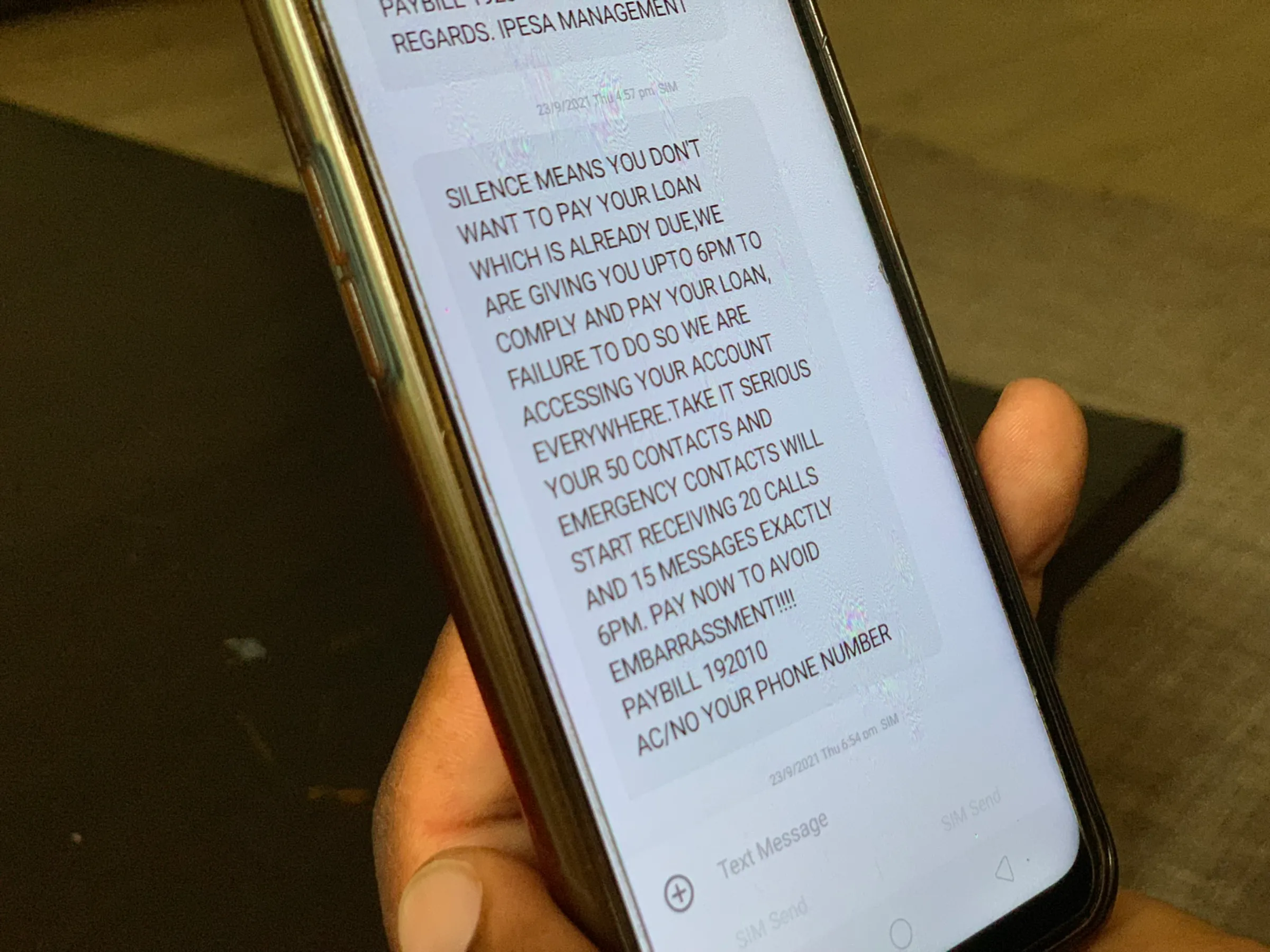

But while the apps offer quick, collateral-free credit to the largely unbanked, the boom has led to a surge in complaints about illegal lenders that routinely abuse customers' data and use aggressive recovery tactics including threats and blackmail.

The country's capital market regulator, the Securities and Exchange Commission of Pakistan, had by May received 1,415 such complaints against licensed digital lenders and 181 against unlicensed ones, and federal police are investigating apps involved in blackmailing clients.

Many more cases likely go unreported, said Nighat Dad, a lawyer who runs the Digital Rights Foundation, a Pakistan-based non-profit, which has been documenting abuses involving loan apps - from excessive interest rates to demands for early payment and blackmail using customers' personal contacts.

Many of the apps do not include contact details, making it impossible for aggrieved customers to seek redress.

Dad said poor digital literacy had made people vulnerable to apps that promise quick solutions.

Since the COVID-19 pandemic, smartphone use has surged in Pakistan as elsewhere, making mobile-based lending apps more accessible for people seeking "emergency financing", said Raja Ateeq Ahmed, an official at the Securities and Exchange Commission of Pakistan.

The loan apps are also cashing in due to the cumbersome process and bureaucratic hurdles involved in getting a bank loan, industry experts say.

"Banks require income statements and have a strict, rather discouraging, regime for people in need of money. Also, banks do not offer small loans or loans for shorter terms such as for a week or for a month," said Fahd Ali, who teaches at the Information Technology University in Lahore.

Extortion money

Another Lahore resident, a 26-year-old woman who asked not to be named, said she rued the day she had registered herself on a loan application she came across while browsing social media.

She did not apply for a loan but received a deposit of 10,000 rupees in her bank account several days later, a sum she promptly returned.

"Denying receiving any money from me, first they persistently contacted me and then pestered my friends and family exploiting the access granted to my contact lists ... hurling threats and abuse," she said.

In the end, she paid about 40,000 rupees in extortion money to stop the threats, but the calls have continued and she has reported the app to the authorities.

Ahmed from the markets regulator said aggrieved customers form a tiny portion of those borrowing from loan apps, but concerned about the rise in complaints, the commission has issued new guidelines for digital lenders.

Non-bank financial companies (NBFCs) that disburse loans through digital channels will have to disclose the credit amount, rates, fee and charges, and the duration of the loan to consumers through audio or video and emails and text messages in both English and Urdu.

They will be banned from accessing a borrower's contacts lists or pictures on their mobile phone "even if the borrower has given consent", the regulator said in a statement.

Google also requires lending apps to submit country-specific licensing documentation to prove their ability to provide or facilitate personal loans, and has restricted personal loan apps from accessing user contacts or photos.

Digital rights activists say, however, that even tougher rules are needed to ensure compensation and redress for victims.

"The regulation should aim to uphold the rights of consumers, empowering them to report fraudulent apps and creating mechanisms for amount recovery," said Dad, adding that people from low income segments were most exposed.

In Lahore, Ali urged people facing financial difficulties not to resort to rogue lenders.

"It's better to die in misery than to borrow ... from these loan sharks," he said.

($1 = 283.4000 Pakistani rupees)

(Reporting by Waqar Mustafa in Lahore; Editing by Helen Popper.)

Context is powered by the Thomson Reuters Foundation Newsroom.

Our Standards: Thomson Reuters Trust Principles

Tags

- Finance

- Fintech

- Consumer protection

- Wealth inequality

- Tech and inequality

- Tech regulation

- Data rights