Context is powered by the Thomson Reuters Foundation Newsroom.

Our Standards: Thomson Reuters Trust Principles

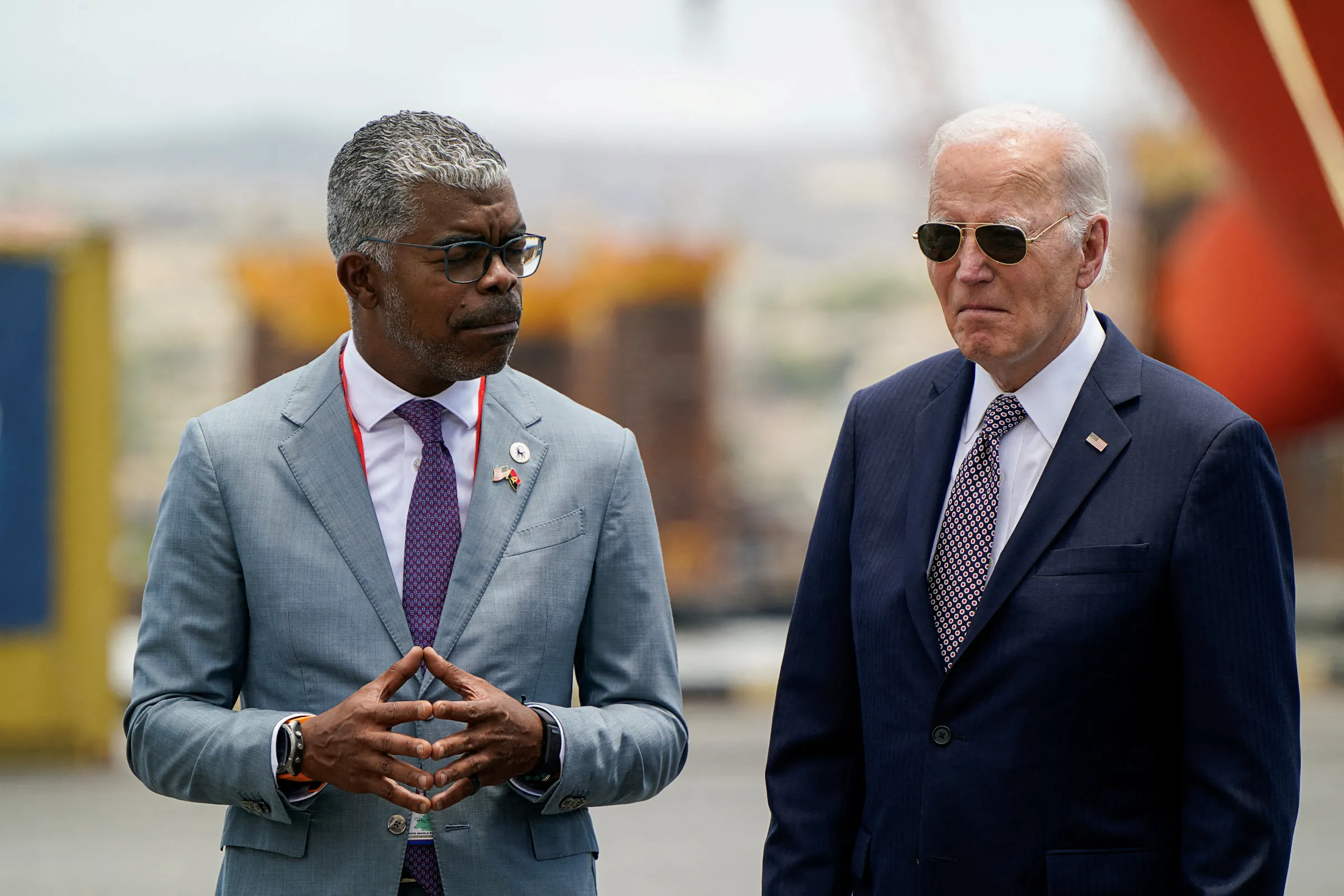

U.S. President Joe Biden stands with Angolan Minister of Transport Ricardo Daniel Sandao Queiros Viegas de Abreu, during a visit to the Lobito Port Terminal in Lobito, Angola, December 4, 2024. REUTERS/Elizabeth Frantz

Biden's visit to Angola highlights a world hungry for Africa's natural resources...and a big fight to come

JOHANNESBURG - Outgoing U.S. President Joe Biden has less than two months left in the job, but he still squeezed in a last-minute trip to Africa this week - and wants China to take note.

Topping Biden's agenda is the U.S.-backed Lobito railway in Angola, a crucial transport route for high-value minerals such as lithium and cobalt - vital to the world's avowed ambition to swap heavily polluting fuels for cleaner sources of energy.

It is the first U.S presidential visit to sub-Saharan Africa since 2015 and comes as the world's biggest economies fight for control over the continent's sought-after minerals.

From mobile phones to solar panels, electric cars to wind turbines, Africa's minerals are critical to a host of emerging technologies and cleaner energy sources.

Their estimated value is $6.2 trillion, according to the African Development Group.

China and Germany are two of the biggest consumers, according to the World Bank.

So, what does Biden's visit tell us about the race for Africa's critical minerals, and who best stands to benefit?

From South African manganese to cobalt in the Democratic Republic of Congo and Zimbabwe's lithium, 30% of the world's mineral reserves are found in Africa, according to the South African Institute of International Affairs (SAIIA).

When it comes to clean industries such as electric vehicles or solar panels, 40% of critical minerals are found in Africa.

It is home to 55% of the world's cobalt, 48% of manganese and 21.6% of natural graphite - all vital in battery production, according to the United Nations Trade and Development (UNCTAD).

The United States is competing for mineral access against China, which has invested two decades worth of infrastructure and trade agreements under a Belt and Road initiative with a host of African countries.

In DRC, the world's biggest producer of cobalt and its No.3 copper producer, mining is dominated by Chinese companies which have stakes in 15 of the country's 17 cobalt mines.

Congo and China are locked in a tug of war over ownership of the vast resources found in the West African nation, with Beijing investing in infrastructure projects in exchange for mineral access.

Only $822 million of the $3 billion promised by China for infrastructure investments had been spent in 2023, said the DRC state auditor, Inspection Generale des Finances (IGF).

In 2022, China-Africa trade volume neared $300 billion, triple that of U.S.-Africa trade, according to the Africa Policy Research Institute (APRI) think tank.

Chinese mining and battery companies have also invested heavily in lithium mines in Namibia, Zimbabwe, and Mali.

A third of all African mineral and metal exports, valued at $16.6 billion, went to China in 2020, APRI found.

This was up 28% from 2018.

The Lobito Corridor railway would link DRC and Zambia to Angola's Lobito port, facilitating exports to the West across the Atlantic Ocean.

The refurbishment of the 1,300-km (800-mile) rail line - part financed with a $550-million U.S. loan - also aims to boost intra-African trade and underpin the continent's economic growth, according to the U.S. Trade and Development Agency.

Biden's visit to discuss the new copperbelt venture came three months after China signed a deal with Tanzania and Zambia to revive a rival railway line to Africa's eastern coast.

About 62% of Africa's GDP stems from its natural resources, according to the African Development Bank.

Yet many African nations have suffered a so-called "resource curse" where their minerals have fuelled conflict and corruption, leaving locals with little positive to show.

The global rush for critical minerals, part of a long history of mineral exploitation, has pushed more than half a dozen African nations to restrict or ban mineral exports.

While African governments may want to retain control, analysts say a lack of local infrastructure, such as battery factories, may scare off potential trade partners.

Rights groups across the continent also say they are routinely left out of the sort of global negotiations on climate change or mining that directly impact their communities.

Take the pan-African Women's Climate Assembly (WCA) - grassroots environmental activists from 17 countries - which wants reparations for the fallout of historic mining, as well as a greater say in future mining to stop history repeating itself.

As time ticks down on Biden, African governments wait to see what a Donald Trump presidency will bring and whether they will be seen as allies or obstacles in the mining of their minerals.

(Reporting by Kim Harrisberg; Editing by Lyndsay Griffiths.)

Context is powered by the Thomson Reuters Foundation Newsroom.

Our Standards: Thomson Reuters Trust Principles