At Climate Week NYC, investors explore solutions for hardest-hit people

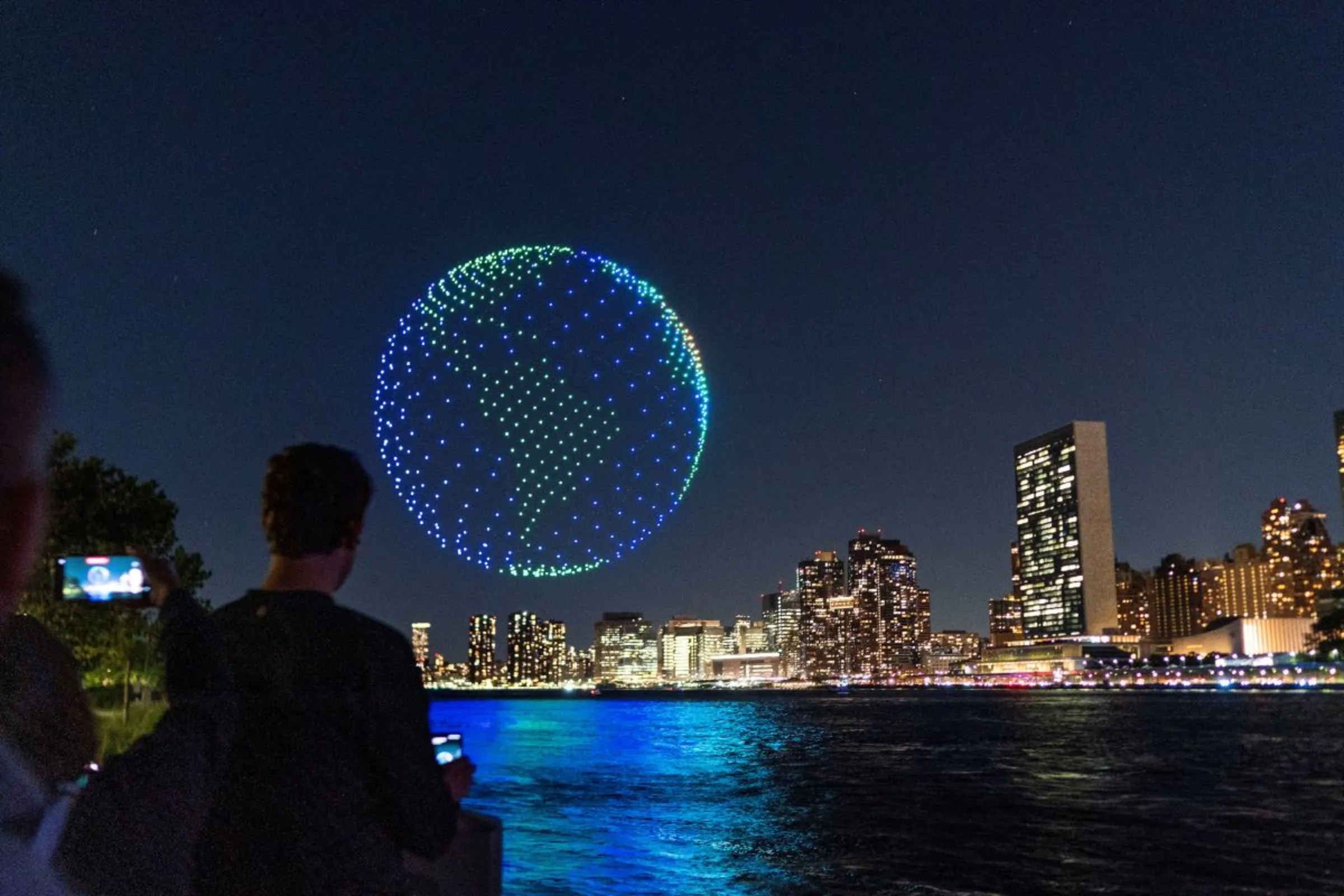

People watch drones creating a 3-D display outside the United Nations Headquarters calling attention to the Amazon rainforest and climate change in New York U.S., September 15, 2023. REUTERS/Eduardo Munoz

What’s the context?

Finance experts say it's important to start small and find out what climate funding local communities need

- Scotland deploys 'non-economic' loss and damage funding

- Green banks catalyze new investment in US and beyond

- Private sector hopes philanthropy can light the way

NEW YORK - From public money for green banks, to efforts to combat gender-based violence, climate leaders across government, business and philanthropy, gathered in New York this week, are pushing new ways to steer vital finance toward combating the climate crisis.

Annual funding needs for meeting long-term climate goals are estimated to be in the trillions - but advocates and investors said it was important to start small and foster discussion with an eye to scaling innovations that help people on the ground.

Humza Yousaf, First Minister of Scotland, this week announced the deployment of £5 million ($6.2 million) in previously pledged funding as part of a "non-economic" loss and damage program with the Climate Justice Resilience Fund, a grant-making group.

The contentious debate over "loss and damage" money for climate change impacts, which has been front and center in recent U.N. talks, often focuses on financial help to recover from direct damage caused by extreme weather such as storms.

But Scotland's funding is meant to address other, usually less visible impacts which nevertheless are tied to the climate crisis, such as harm to health, loss of cultural heritage like cemeteries, or gender-based violence after disasters.

"Not a single community on Earth will be left untouched by the effects of climate change, but that suffering is not divided equally," Yousaf told an event hosted by the Climate Group, which sponsors Climate Week NYC.

"I'm afraid that those of us in the Global North are simply not responding fast enough."

Hyper-local view

Other panels at the annual gathering of advocates, officials and business people on the sidelines of the U.N. General Assembly in New York offered examples of the private sector or philanthropic groups stepping up with new green financing solutions where governments often fall short.

Wealthy nations have famously dragged their feet on meeting a pledge of contributing $100 billion per year to help developing nations in the climate fight, now four years overdue.

For instance, investment firms BlackRock and Temasek have launched a joint venture, called Decarbonization Partners, intended to benefit companies in the clean energy sector.

"It's a challenging time to raise capital," said Meghan Sharp, global head of Decarbonization Partners.

One recent investment she highlighted was in Ascend Elements, a U.S.-based battery company that also specializes in recycling parts from lithium-ion batteries used in electric vehicles - which she described as a "circular economy" story.

"It can essentially take somebody's critical (mineral) elements and get 98% recycled - and do that over and over and over again," she said.

Kelly Fisher, head of corporate sustainability for the United States at HSBC, said her company plans to deploy up to $1 trillion in sustainable investments by 2030 in a bid to get the banking giant's clients on a path to net-zero emissions.

"That finance cannot be provided at the expense of low-income and marginalized communities – it has to take them into consideration," she noted, adding this could be done, for example, through listening to their needs.

Among the projects Fisher touted are an initiative in China to educate textile factory workers about the energy transition, and another in India to train women's collectives to foster renewable energy distribution companies in rural areas.

"We think hyper-specifically regionally," she said.

In the United States, the eastern state of Maryland has a green semi-public bank which has taken about $10.3 million in government funding and leveraged at least $130 million in private capital for projects like clean energy initiatives.

"That just shows how the partnership using the green money is really instrumental in pushing (the) market, pushing those investments," said Maryland Secretary of the Environment Serena McIlwain. "A lot of companies don't really have that money up front."

At the national level, President Joe Biden's Inflation Reduction Act - which budgets roughly $370 billion in spending for the green transition - includes a $27-billion fund devoted in part to financing green banks that leverage public money to boost private investment in renewables.

Philanthropy as catalyst?

Beyond the public sector and direct investment from private companies, the philanthropic world is also eyeing newer mechanisms to deploy climate finance.

The Rockefeller Foundation this month announced it would invest $1 billion over the next five years in the global clean energy transition, including $1 million to develop minigrids in Zambia and $5 million for a fund led by Mombak, a startup in Brazil working on reforestation and carbon credits.

"I think of it as start with philanthropy, but move your way up through the spectrum of capital," said HSBC's Fisher.

The key, she said, is avoiding one-size-fits-all strategies and taking a flexible approach, offering a path from small business lending up to billions of dollars in investments.

"(It) can actually cause a problem if we can come up with a solution and say, well that's going to be the same thing in Denver as it is in Mumbai," she added.

($1 = 0.8066 pounds)

(Reporting by David Sherfinski; Editing by Megan Rowling.)

Context is powered by the Thomson Reuters Foundation Newsroom.

Our Standards: Thomson Reuters Trust Principles

Tags

- ESG

- Adaptation

- Climate finance

- Climate policy

- Communicating climate change

- Climate solutions